About You, The Prospective NYC Renter

You are in the market for an NYC rental apartment and busy, absolutely confused, anxious, nauseous about the entire rental process and are in desperate need of assistance. You finally decide to reach out to multiple tenant agent Brokers for help but then it hits you. "This shit is going to run a few thousand dollars". The assistance of a Broker is definitely needed but how can you negotiate broker fees in NYC to save some money? You need to quickly learn how to negotiate broker fees in NYC. It is simple and can be done but there are a few topics to understand before learning how you negotiate NYC broker fees.

Who Pays the Broker Fee When Renting In NYC?

With Tenant Agents, where the prospective renter is purposefully seeking out a broker for guidance or signing up for help, the broker fee will be paid by the prospective renter. When dealing with Landlord Agents, where the prospective renter is apartment hunting solo without a broker, the broker fee is still sometimes paid for by the prospective renter but also in some cases, paid for by the landlord.

How To Negotiate Broker Fees In NYC 101 For Dummies

It is well known to all New Yorkers looking to rent an apartment in NYC that the standard rental broker fee in NYC is a one-time 15% commission that is paid out of pocket to the rental broker for services rendered. That is 15% of one full year's aggregated rent. Because the NYC rental broker fee is expensive, costing a few thousand dollars per transaction, the common question that gets asked is 'can you negotiate NYC broker fees?'. Though the 15% rate is industry standard, it is NOT gospel nor is it set by law. Therefore like any general service that is provided, the NYC rental broker fee can be negotiable.

This begs the next follow-up questions:

- How much of the NYC broker fee can be negotiated?

- When to negotiate versus letting the rate be?

- Are there hidden traps associated with NYC broker fee negotiations?

What Are The Realistic Expectations On How Much Of The NYC Broker Fee Can Be Negotiated?

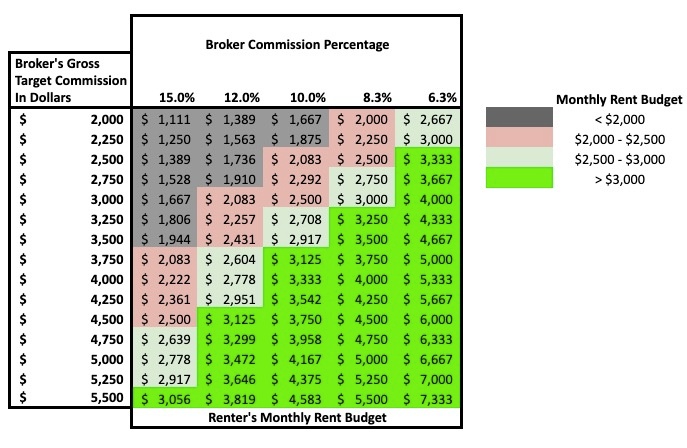

As a prospective renter, consider any negotiating starting point to be at the 15% standard rate. Because that rate has been the standard percentage for years, any negotiations to get a lower rate start from there. Keep in mind as of late, there has been much evidence of broker fees having shifted towards a cost of 1 month's rent, which is equivalent to an 8.3% rate. Clearly much lower than the 15% standard rate. So what gives? It is more likely that the 8.3% number is agreed upon ONLY if the commission dollar amount is above a certain threshold. Negotiating a lower rate requires context and is not as simple as just asking for it.

The first question a broker always asks is "What is your rental budget?". They ask because it helps them size up the potential commission dollars immediately and whether or not they should spend the time to take on the work. There is something of a mental rate card and a target commission that decides whether a deal is worth their time.

Keep in mind the matrix is only taking into account the gross commission dollars. It is not taking into account the splits the broker has to share with their firm, or the splits the broker may have to share with a landlord agent. These are examples of contributing factors to whether a broker fee is negotiable or not. For the broker, obviously the more the commission dollars the better but practically speaking, in order to maintain a standard of living in NYC, a broker wants a run rate of closing 1 transaction a week at an average deal size of $3,000.

What this means for the renter is that if your monthly rent budget is:

- < $2,000 - Negotiating down a couple of percentage points from 15% to 12% is about as far as it will go. Push any further and you may find yourself hunting for an apartment alone.

- $2,000 to $3,000 - Negotiating the rate to 10% is a more plausible outcome but not likely to go down further.

- > $3,000 - Negotiating from 1 month's rent (8.3%) is well within reason. The higher the rental budget, the lower the rate can go.

Why has the standard rate shifted to 1 month's rent nowadays? It's not for certain but one reason could be due to the fact that rent prices have gone up quite substantially over the last decade. Studio apartments that went for $1500 per month in 2010 now run $2500 in 2020. Even if broker fee percentages were to remain flat while rent prices continue to go up, it would make it increasingly difficult for prospective renters to afford broker services. While the broker fee percentages may have shifted lower, the actual cost of the broker fee in dollar amounts has remained relatively the same.

When To Press The Negotiations And When To Let It Go

What about those stories and posts around the web where agreements on rates have reached 6% (3 weeks rent) or even 4% (1/2 months rent)? Though it happens, it is definitely infrequent and must be put into context. For a broker, the fixed part of the service they provide is the time spent working with a prospect(s). Time is finite and there are only so many hours in the day a broker has to service a renter. The variable part of the service is the renters' monthly rental budget. Because broker commissions are based on the rent price of the transaction, they can make more dollars on a deal that is priced higher at a lower percentage rate versus a deal that is priced lower at a higher percentage commission rate. Meanwhile, both deals require spending the same amount of time.

This means there is an obvious preference between working with 2 friends fresh out of college about to embark on their first jobs with a combined budget of $2,800 versus working with an established single working professional that has a $5,000 budget. A group of friends banning together with an $8,000 budget is even better! The unfortunate reality is the higher your rent budget is, the more negotiating power you have.

If your budget is high, there are going to be plenty of brokers willing to work with you and negotiate their fees down. The people with a lower budget who may actually need the break on fees the most might not ever any. If your budget is on the lower end and you absolutely need the help of a broker, tread the negotiations lightly or you'll be back to square one looking for another broker.

The Hidden World Of Rental Incentives Filled With Traps and Gotchas

It is common knowledge that property managers offer incentives directly to prospective renters in order to close a deal. It is also common for property managers to offer similar incentives directly to brokers to entice them to bring prospects to their apartments. When these incentives are available, it drastically skews the broker fee negotiations in favor of the renter. In these instances, the broker fee actually goes away with little negotiation necessary. In some cases, you can further negotiate on taking more of the incentive for yourself. There are a handful of scenarios to keep an eye out for.

- Months Free - If a property manager is offering one month's free rent as an incentive to direct renters, as a renter, that one month's free incentive can be used as a substitute for the broker fee. If the property manager is offering two months of free rent, one month of that could be used as a substitute for the broker fee while as a renter, you get the other month. From there, you may be able to take it a step further by negotiating the broker's incentive. For example, if the property manager provides one month's free rent, you can negotiate a split of that with the broker by asking for half. Available incentives give the renter the upper hand in negotiations.

- Owner Paid Only - Also known as the 'OP'. Property managers may only offer an incentive to a broker for bringing in a prospective renter but no incentive for renters who go direct to the property manager. Offering only an OP is not as prevalent as the months' free rent but it does happen. Negotiating a split on the OP with the broker is more difficult because the property manager does not offer it directly to renters so it is harder to use as a bargaining chip. Though with the OP in mind, there are many instances where a renter going directly to the property manager without a broker is able to negotiate lower than asking rent because the OP can be used as a negotiating tool. From the property manager's perspective, if the OP offered is worth $3,000 and they no longer have to pay that out, what is it worth? Lowering rent by $50, $100, $200 a month for a renter that went direct? It happens enough times.

- Months Free & Owner Paid - Each side gets its own where the renter gets the months free and the broker gets the OP. Generally, it is still a negotiable scenario as well because the broker commission dollars are coming from the property manager and it makes conversations about broker commission dollars with the prospective tenant much easier. Brokers will take any deal involving an OP. Could you take the months free and then a piece of the OP? Definitely negotiable because if one broker says no, another broker may take it. There are a handful of rental brokerages out there that are operating a huge portion of their businesses on this model.

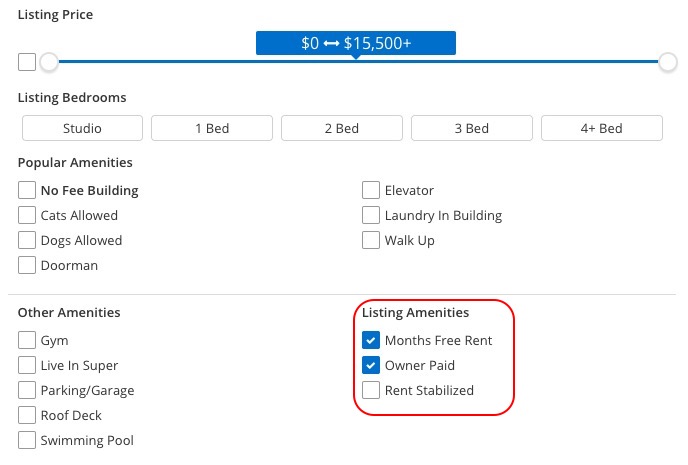

Which begs the next question. How do you know when these incentives are available and where do you find them? Fortunately, they are available online on many websites. You have to keep an eye out for them.

On sites like Transparentcity, the incentives are easier to find because instead of having to scour through descriptions of listings line by line, you can simply filter on those fields.

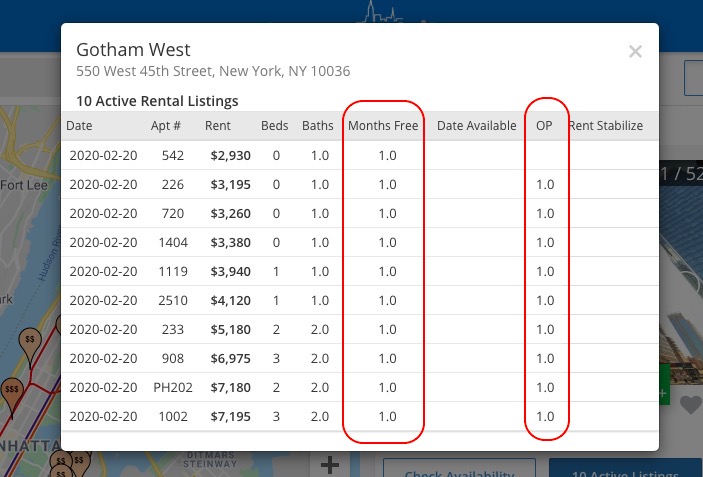

And then check the listings within a building to see how much of the incentives are offered:

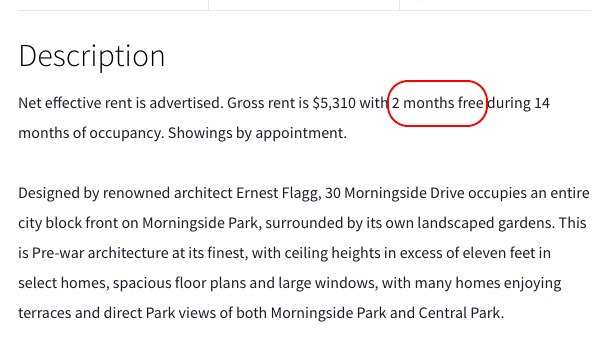

On other aggregator sites, the information, if available, will be placed within the listing description of a post. It's there but you have to read through them. Here is an example from Streeteasy.

When incentives are provided, the key broker fee negotiation point is that you should no longer pay a broker fee. Don't get 'double dipped' where you pay out of pocket for a fee while the Broker is also collecting incentives from the property manager. It's a monster payday for Brokers and happens frequently if the prospective renter is not paying attention.

As a renter, you have the leverage to not only bypass the broker entirely, save on the fee and deal directly with the property managers but you also have the ability to negotiate with the property manager by using the incentives to get the asking price on the rent lowered.

There is how to negotiate the NYC broker fee in a nutshell. Happy Negotiating!