Let's just get right to it, I’m sure I’m not the only one who has heard friends complain about having to dish out an extra $5,000 in broker fees just to get their apartment. So, what exactly is the typical broker fee in NYC, and how exactly does this work?

Well, there is not exactly a one size fits all scenario for this so let me break it down for you. There are “open listings” and there are “exclusive listings”. Whenever there are two brokers involved (one representing you and one representing the landlord) this almost always means there is a total of a 15% fee charged based on the annual rent. Here is an example, let's say you rent a $3,000 apartment and there is a 15% fee. $3000 x 12 (the annual rent) = $36,000 x 15% (the percentage charged) = $5400 broker fee! The fee is usually then split between the 2 brokers and split down further between the brokerages etc. One thing to note is that 90% of listings in new york are exclusive listings, meaning they will have a 15% fee.

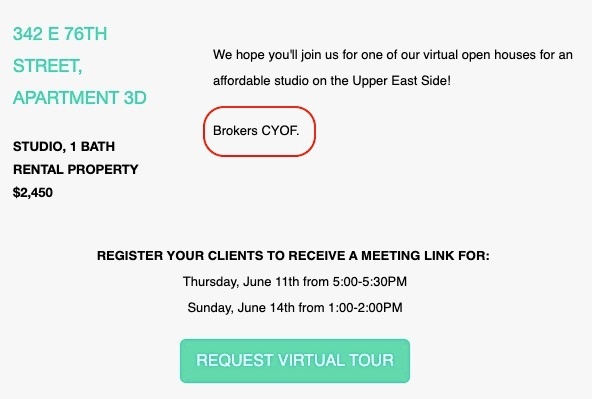

On an open listing, usually meaning only 1 broker is involved, there is usually more room for negotiation. Another name for this is “CYOF", this is broker speak for Collect Your Own Fee. It means the broker can charge you anywhere from a minimum of 1 month's rent to a maximum of 15% (it is unethical for any broker to charge more than 15% in NYC). Most brokerages will not allow their brokers to charge less than 1 month's rent so just have this in the back of your mind when you're looking to shop around. See this example Ad posted by a broker telling tenant agents they would have to collect their own broker fee because the listing agent is not willing to co-broker and split the fee they are collecting from the landlord.

Now, let's dive into everyone's favorite fee type, “NO FEE!”. This can go a couple of different ways, but one important thing to remember is that there is no such thing as a free lunch, and this is especially true in New York!

This usually means that the landlord is paying the broker fee, which upfront sounds like a great deal. One important factor to keep in mind is that real estate is a business like any other if they are going to give up money in one way, they are going to have to recoup it in another. To put this in layman's terms, while you may not have to shell out $5,400 upfront, your overall rent may be an extra $100-$200 more per month, so over the course of the year, it usually ends up evening out. Often, it is also used as an incentive to draw more customers into the apartment that may be undesirable for a number of different reasons.

One last important fact to keep in mind is that if you are going to a no-fee apartment, make sure that you go directly without your own personal broker and that you are meeting either directly with the landlord/management company or with their representing broker. Only go with your broker if the landlord has explicitly advertised that they will pay your brokers (this is called an OP, aka “Owners Pay”). If you go with your own personal broker to a no-fee listing they are still entitled to collect a fee from you because they introduced you to the apartment.

Brokers have a bad rep for being shady, but a lot of this confusion and miscommunication stems from an unclear understanding of the commission structure, and because there are so many it can be difficult to explain. When you first meet with your broker, it might be a good idea to walk through the apartments you are seeing and ask them to explain to you how each fee is structured based on the apartment. After all, fees are dependent on the apartment, not the building or the broker, and often apartments in the same building do not have the same fee structure.

If you decide to go without a broker and want to look for no-fee buildings, check out Transparentcity.