There are plenty of pros and cons to living in NYC . On the plus side, you get to live in the Big Apple and experience the lifestyle it has to offer. On the other hand, it can be pretty expensive to live in New York City . Luckily, here are some living in NYC on a budget tips to give you a general idea of what to expect and to help you enjoy city living without breaking the bank.

What’s the Average Salary In NYC?

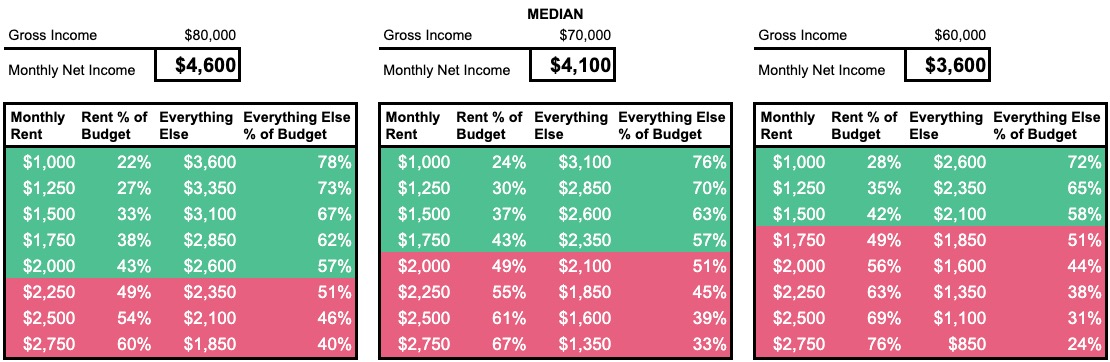

The average salary, once you move to New York City, depends on the job you have. Generally speaking, the median has been reported to be about $69,981. As of the first quarter of 2019, average wages are showing a positive trend with an increase of 0.6%. Since living in New York is over 120% higher than the average cost of living in the United States, this rising median wage is going to be very helpful for new residents. That median $70,000 salary equates to roughly $4,100 in monthly net income take home pay after Uncle Sam, the Big Apple state and AND the city all take a humongous bite out of your gross earnings in the form of taxes. Depending on where your salary falls above or below the median, you can do a plus/minus of a few hundred dollars a month in net cash take home pay, which is the actual dollar amount that goes into your bank account and not what your employer makes you think you're making.

Breaking down this salary is an important part of living on a budget. Making a plan ahead of time is going to make all the difference. Planning ahead will keep you from being caught off guard in the event of a financial emergency. It’s a good idea to start saving a little bit of every paycheck to be used in the event that you lose your job or have a sudden expense.

Making A Budget

The truth about budgeting is that no one else can tell you what your budget should be. Looking for inspiration in other people’s budgets is a good idea, as it will give you an idea of how budgets can be broken down differently. Don't believe that you can simply copy another person’s budget and use it verbatim. You’ll need to create a unique budget based on your salary and spending habits.

To create a budget, you’ll need to use your monthly as a total amount of money that you divide into different categories. With that total in mind, look back at your spending habits in the past three months and try to find trends. Look at where you're spending money, as well as how much is being spent in these areas. Divide your spending up into categories such as rent, groceries, transportation, alcohol, restaurants, cable, gym memberships and any other categories that may be relevant to you.

Using your total monthly salary, break this total down into amounts that will be spent on the various categories you created. You will likely find that rent will take up most of the total, with the others being much smaller. Once you’ve broken down your salary, you’ve created your budget. It will likely take some tweaking over the following weeks, but this is totally normal.

Keep in mind that rent in NYC should be budgeted as a fixed amount of dollars whereas the rest of your spending habits are all variables. Rent is also higher in NYC than it is in the rest of the country. Also the general rule of making a salary that is equivalent to 40x rent also applies here because landlords what to to make sure the incoming cash can cover the monthly rent costs.

Here we lay out some general budget guidelines for a single person of what to expect when renting in NYC if your income is around the NYC median. Monthly rent is a fixed cost and then you have leftover money that you could spend on everything else:

Realistically in this city, rent costs is going to take up between 40%-50% of your take home pay. In many cases, it is actually more than half and renters are barely scraping by. It is almost mandatory that you roommate up if your income is below the median because there are no solo apartments available below $1,500 a month in the city.

The red/green line breaks generally around the cutoff where monthly rent almost equates to the remaining spend. It starts to become a major red flag if your monthly rent is is over 60% of your monthly take home pay. If you're living in NYC, you need to actually live a little and go out in NYC.

Where do you want to fall in the spectrum?

Sticking To Your Budget

It’s important to remember that making a budget is only the first step to solving the problem. Keeping in mind, it is very possible to have less than half of your take home pay after paying rent. The second, and much harder, part is actually living within that budget. It’s easy to start living outside your budget, but this is especially easy in NYC. You may find that you can’t go out as often, because of the limitations of your budget. Living on a budget may mean that you can’t go out and shop as much or go out to the bar as often, but this doesn’t mean you can’t have fun. There are fun things going on in NYC every day, many of which are free.

In the event that you do go over budget one month, don’t give up on your budget entirely. Examine where your budget needs to be adjusted to make the changes necessary to prevent going over budget again.

Living in NYC may seem impossible when you’re on a budget. It may be an expensive city, but it’s totally possible to live in NYC if you follow the tips listed out.

Finding an Apartment

The first part of living in NYC on a budget is finding an apartment. This can be a bit difficult, as the market in NYC is quite different from the market in other large cities. In NYC, it’s common for people to use a broker to find an apartment, as many buildings only work through brokers. This can be costly for renters, and spending money on a broker can really wreck an already tight budget. Imagine having to pay a full months of your net take home pay to a broker?

One way to avoid using a broker is to look on transparentcity.co for listings. This site shows listings that work directly with landlords, cutting out the broker entirely. This can save you thousands in broker’s fees when you find an apartment.